"Positioning for change; staying ahead of the curve; we're keeping watch for you!"

THE MARKET PIVOTS FORECASTER AND POSITION MANAGEMENT NEWSLETTER

and

THE ETF PIVOTS FORECASTER AND POSITION MANAGEMENT NEWSLETTER

and

THE E-MINI FUTURES PIVOTS FORECASTER AND POSITION MANAGEMENT NEWSLETTER

in association with

THE ECHOVECTOR MARKET PRICE PIVOTS FORECASTER AND POSITION MANAGEMENT NEWSLETTER

FREE ONLINE VERSIONS

Currently regularly updated and FREE online version market newsletters providing valuable and timely market price path analysis and price forecast charts and potential price pivot timing indicators, advanced market price echovectors and echovector price echo-back-dates, advanced forecast echovector price pivot points, key echovector price inflection points, and advanced coordinate forecast echovector support and resistance vectors for select stocks, bonds, commodities, currencies, and emerging markets composites, with a strong focus on select, proxying and indicative futures and ETF instruments in key markets.

OUR RESEARCHING VIEWERSHIP NOW INCLUDES VIEWS FROM OVER 75 COUNTRIES AROUND THE WORLD! TOTAL VIEWS NOW INCLUDE REGISTERED VIEWS FROM...

Argentina/ Australia/ Austria/ Bangladesh/ Belarus/ Belgium/ Belize/ Bermuda/ Brazil/ Burma/ Canada/ Chile/ China/ Columbia/ Costa Rica/ Croatia/ Cyprus/ Czech Republic/ Ecuador/ Egypt/ Estonia/ France/ Finland/ Germany/ Greece/ Guam/ Guernsey/ Hong Kong/ Hungary/ India/ Indonesia/ Iraq/ Ireland/ Israel/ Italy/ Jamaica/ Japan/ Jordan/Kazakhstan/ Korea/ Latvia/ Lithuania/ Malaysia/ Mexico/ Namibia/ Nepal/ Netherlands/ New Zealand/ Nigeria/ Norway/ Panama/ Pakistan/ Philippines/ Poland/ Portugal/ Romania/ Russia/ Saudi Arabia/ Serbia/ Singapore/ Slovakia/ South Africa/ Sri Lanka/ Spain/ Sweden/ Switzerland/ Taiwan/ Thailand/ Trinidad and Tobago/ Turkey/ Ukraine/ United Arab Emirates/ United Kingdom/ United States/ Uzbekistan/ Venezuela/ Vietnam

PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP PRECISION PIVOTS ARTICLES HAVE APPEARED IN PUBLICATION OR IN SYNDICATION IN YEARS 2013 OR 2014 AT

Nasdaq, CNBC, MSN Money, Yahoo Finance, MarketWatch, Reuters, Barrons, Forbes, SeekingAlpha, BizNewsToday, Benzinga, Business Insider, Daily Finance, StreetInsider, Top10Traders, Fixed Income and Commodities, EchoVectorVEST, Financial Visualizations, YCharts, XYZ Trader Systems, ZeroHedge, Predict WallStreet, Financial RoundTable, Financial Board Central, Bullfax, BizWays, The Finance Spot, Business News Index, Regator, Streamica, BusinessBalla, Finanzachricten, StockLeaf, News Now UK, The Economic Times, Finance Pong, Seeking Alpha Japan, Gold News Today, GoldPivots, AurumX, Sharps Pixley News, Royals Metal Group, A-Mark Precious Metals, Sterling Investment Services, Austin Rare Coins and Bullion, Gold Trend, GoldPrice Today, Gold Rate 24, Check Gold Price, Silver Price News, Silver News Now, Silver Phoenix 500, Silver News, Silver Price, Silver Prices Today, Precious-Metals, VestTrader, Value Forum, Coin Info, Investment Four You, AidTrader, Trend Mixer, Indonesian Company, SiloBreaker, ETF Bannronn, SportBalla, Trading Apples, US Government Portal, Do It Yourself Investor, News Blogged, and others.

PROTECTVEST AND ADVANCEVEST

BY ECHOVECTORVEST MDPP PRECISION PIVOTS

"Positioning for change, staying ahead of the curve, we're keeping watch for you!"

METHODOLOGY NOTES

"EchoVector Theory and EchoVector Analysis assert that a securities prior price patterns may influence its present and future price patterns. Present and future price patterns may then, in part, be considered as 'echoing' these prior price patterns to some identifiable and measurable degree.

EchoVector Analysis is also used to forecast and project potential price Pivot Points (referred to as PPP's --potential pivot points, or EVPP's --EchoVector Pivot Points) and active, past and future coordinate forecast echovector support and resistance echovectors (SREV's) for a security from a starting reference price at a starting reference time, based on the securities prior price pattern within a given and significant and definable cyclical time frame.

EchoVector Pivot Points and EchoVector Support and Resistance Vectors are fundamental components of EchoVector Analysis. EchoVector SREV's are constructed from key components in the EchoVector Pivot Point Calculation. EchoVector SREV's are defined and calculated and also referred to as Coordinate Forecast EchoVectors (CFEV's) to the initial EchoVector (XEV) calculation and construction, where X designates not only the time length of the EchoVector XEV, but also the time length of XEV's CFEVs. The EchoVector Pivot Points are found as the endpoints of XEV's CFEVs' calculations and the CFEVs' constructions.

The EchoVector Pivot Point Calculation is a fundamentally different and more advanced calculation than the traditional pivot point calculation.

The EchoVector Pivot Point Calculation differs from traditional pivot point calculation by reflecting this given and specified cyclical price pattern length and reference, and its significance and information, within the pivot point calculation. This cyclical price pattern and reference is included in the calculations and constructions of the echovector and its respective coordinate forecast echovectors, as well as in the calculation of the related echovector pivot points.

While a traditional pivot point calculation may use simple price averages of prior price highs, lows and closes indifferent to their sequence in time to calculate its set of support and resistance levels, the echovector pivot point calculation begins with any starting time and price point and respective cyclical time frame reference X, and then identifies the corresponding "Echo-Back-Date-TimeAndPrice-Point (EBD-TPP)" within this cyclical time frame reference coordinate to the starting reference price and time point A. It then calculates the echovector (XEV) generated by the starting reference time/price point and the echo-back-date-timeandprice-point, and includes the pre-determined and pre-defined accompanying constellation of "Coordinate Forecast EchoVector" origins derived from the prior price pattern evidenced around the echo-back-date-timeandprice-point within a certain pre-selected and specified range (time and/or price version) that occurred within the particular referenced cyclical time-frame and period X. Security I's EchoVector Pivot Point constructions then calculate and project the scope relative echovector pivot points that follow A, and the support and resistance levels determined by the ensuing coordinate forecast echovectors and their selected range definition inclusion (fully differentiating the time-sequence of the origins), the cyclical time-frame X, and to XEV's slope.

EchoVector Pivot Points are therefore advanced and fluid calculations and effective endpoints of projected coordinate forecast echovector support and resistance time/price levels, projections that are constructed from and follow in time from the starting reference price, time/price point A (echovector endpoint) of the initial subject focus echovector construction, and which occur within an EchoVector Pivot Point Price Projection Parallelogram construct: levels which are derived from coordinate (support and/or resistance) forecast echovectors calculated from particular 'scope and range defined' starting times and price points reflecting the time and price points of proximate scale and scope and time/price pivoting action that followed the initial subject focus interest echovector's echo-back-date-time-price-point B (derived from and relative to the initial subject focus echovector's starting time-point and price-point A, and the echovector's given and specified cyclically-based focus interest time-span X, and the initial subject focus echovector's subsequently derived slope relative momentum measures).

The EchoVector Support and Resistance Vectors, referred to as the Coordinate Forecast Echovectors, are used to generate the EchoVector Pivot Points."

From "Introduction to EchoVector Analysis And EchoVector Pivot Points" COPYRIGHT 2013 ECHOVECTORVEST MDPP PRECISION PIVOTS

DEFINITION: THE ECHOVECTOR

"For any base security I at price/time point A, A having real market transaction and exchange recorded print price p at exchange of record print time t, then EchoVector XEV of security I and of time length (cycle length) X with ending time/price point A would be designated and described as (I, Apt, XEV); EchoVector XEV's end point is (I, Apt) and EchoVector XEV's starting point is (I, Ap-N, t-X), where N is the found exchange recorded print price difference between A and the Echo-Back-Date-Time-And-Price-Point of A, being (A, p-N, t-X) of Echo-Back-Time-Length X (being Echo- Period Cycle Length X).

A, p-n, t-X shall be called B (or B of I), being the EBDTPP (Echo-Back-Date-Time-And-Price-Point)*, or EBD (Echo-Back-Date)*, or EBTP (Echo-Back-Time-Point) of A of I.

N = the difference of p at A and p at B (B being the 'echo-back-date-time-and-price-point of A found at (A, p-N, t-X.)

And security I (I, Apt, XEV) shall have an echo-back-time-point (EBTP) of At-X (or I-A-EBTP of At-X; or echo-back-date (EBD) I-A-EBD of At-X): t often displayed on a chart measured and referenced in discrete d measurement length units (often OHLC or candlestick widthed and lengthed units[often bars or blocks]), such as 1-minute, 5-minute, 15-minute, 30-minute, hourly, 2-hour, 4-hour, 6-hour, 8-hour, daily, weekly, etc."

DEFINITION: ECHOVECTOR PIVOT POINTS: CLICK HERE

"For any base security I at price/time point A, A having real market transaction and exchange recorded print price p at exchange of record print time t, then EchoVector XEV of security I and of time length (cycle length) X with ending time/price point A would be designated and described as (I, Apt, XEV); EchoVector XEV's end point is (I, Apt) and EchoVector XEV's starting point is (I, Ap-N, t-X), where N is the found exchange recorded print price difference between A and the Echo-Back-Date-Time-And-Price-Point of A, being (A, p-N, t-X) of Echo-Back-Time-Length X (being Echo- Period Cycle Length X).

A, p-n, t-X shall be called B (or B of I), being the EBDTPP (Echo-Back-Date-Time-And-Price-Point)*, or EBD (Echo-Back-Date)*, or EBTP (Echo-Back-Time-Point) of A of I.

N = the difference of p at A and p at B (B being the 'echo-back-date-time-and-price-point of A found at (A, p-N, t-X.)

And security I (I, Apt, XEV) shall have an echo-back-time-point (EBTP) of At-X (or I-A-EBTP of At-X; or echo-back-date (EBD) I-A-EBD of At-X): t often displayed on a chart measured and referenced in discrete d measurement length units (often OHLC or candlestick widthed and lengthed units[often bars or blocks]), such as 1-minute, 5-minute, 15-minute, 30-minute, hourly, 2-hour, 4-hour, 6-hour, 8-hour, daily, weekly, etc."

DEFINITION: ECHOVECTOR PIVOT POINTS: CLICK HERE

on SUN, Mar 2, 2014,

• SLV, GLD, IAU, GTU, NUGT •

GLOBALLY PUBLISHED AND SYNDICATED ARTICLE

on WED, Feb 26, 2014, With THU Update

• GLD IAU, GTU, NUGT, SLV •

PREMIUM MARKET ALPHA NEWSLETTER GROUP ARTICLE NOW FREELY AVAILABLE GLOBALLY

on WED, Feb 25, 2014 • GLD, IAU, GTU, NUGT, SLV •

PREMIUM MARKET ALPHA NEWSLETTER GROUP ARTICLE NOW FREELY AVAILABLE GLOBALLY

on TUES, Feb 25, 2014, w/ FRI UPDATE • GLD, GTU, NUGT •

PREMIUM MARKET ALPHA NEWSLETTER GROUP ARTICLE NOW FREELY AVAILABLE GLOBALLY

on , Jan 12, 2014 • GLD, IAU, GTU, NUGT, SLV •

PREMIUM MARKET ALPHA NEWSLETTER GROUP ARTICLE NOW FREELY AVAILABLE GLOBALLY

on WED, Aug 1 • DIA, IYM, SPY, IWM, QQQ •

GLOBALLY PUBLISHED AND SYNDICATED ARTICLE

(First Published August, 2012)

on THU, Sept 1, 2013 * GLD, IAU, GTU, NUGT, SLV *

PREMIUM MARKET ALPHA NEWSLETTER GROUP ARTICLE NOW FREELY AVAILABLE GLOBALLY

on FRI, Aug 31, 2013 • GLD, IAU, GTU, NUGT, SLV •

GLOBALLY PUBLISHED AND SYNDICATED ARTICLE

on WED, Aug 28, 2013 • DIA, SPY, QQQ, IWM •

GLOBALLY PUBLISHED AND SYNDICATED ARTICLE

on THU, Aug 22, 2013 • SLV, GLD, NUGT •

GLOBALLY PUBLISHED AND SYNDICATED ARTICLE

on WED, Aug 14, 2013 • GLD, NUGT, IAU, GTU, SLV •

GLOBALLY PUBLISHED AND SYNDICATED ARTICLE

on FRI, Aug 9, 2013 • GLD, NUGT, IAU, GTU, SLV •

GLOBALLY PUBLISHED AND SYNDICATED ARTICLE

on WED, Aug 7, 2013 • DIA, IYM,SPY, DIA, IWM,QQQ •

GLOBALLY PUBLISHED AND SYNDICATED ARTICLE

on MON, Aug 5, 2013 • TLT, BOND •

GLOBALLY PUBLISHED AND SYNDICATED ARTICLE

on WED, Jul 31, 2013 • SLV, AGOL, GLD •

GLOBALLY PUBLISHED AND SYNDICATED ARTICLE

on MON, May 31, 2013 • GLD, GTU, IAU, NUGT, SLV •

GLOBALLY PUBLISHED AND SYNDICATED ARTICLE

GOLDPIVOTS.COM PREMIUM RELEASE: 7-POINT MORNING BRIEF: Gold Metals Market Analysis With EchoVector Pivot Point FrameCharts Included: MDPP Premium Desk Release: Friday 28 February 2014: GLD ETF

This Week's EchoVector Pivot Point Analysis And Chart: Gold

Fri, Feb. 28"A Time For Gold Caution, Or A Time To Buy More?" PREMIUM ARTICLE RELEASE TO MARKET ALPHA BRAND NEWSLETTERS GROUP. ARTICLE NOW AVAILABLE ONLINE FREE GLOBALLY. GOLDINVESTORWEEKLY.COM AND GOLDPIVOTS.COM AND COMMODITYPIVOTS.COM AND MARKET-PIVOTS.COM

CAUTION ALERT: GOLD METALS MARKET: GLD ETF PRESIDENTAL CYCLE ECHOVECTOR PIVOT POINT ANALYSIS FRAMECHART UPDATE AND OTAPS-PPS ACTIVE ADVANCED POSITION MANAGEMENT ALERT: TUESDAY 2/25/14: PREMIUM MARKET ALPHA BRAND NEWSLETTER GROUP RELEASE

/ES EMINI FUTURES S&P500 STOCK COMPOSITE INDEX ECHOVECTOR PIVOT POINT ANALYSIS FRAMECHARTS & OTAPS-PPS POSITION POLARITY SIGNAL VECTOR FORECAST GUIDEMAPS UPDATE: TUES 2/25/14 115PMEST: PREMIUM DESK PARTIAL RELEASE TO MARKET ALPHA NEWSLETTERS GROUP ET AL

S&P500 STOCK COMPOSITE INDEX /ES EMINI FUTURES ECHOVECTOR PIVOT POINT ANALYSIS FRAMECHART AND OTAPS-PPS POSITION POLARITY SWITCH SIGNAL VECTOR GUIDEMAP UPDATES: TUESDAY 2/25/14 1107AM EST: US MARKET: WEEKLY & BI-WEEKLY ECHOVECTOR ANALYSIS PERSPECTIVES

S&P500 STOCK COMPOSITE INDEX /ES EMINI FUTURES ECHOVECTOR PIVOT POINT ANALYSIS FRAMECHART AND OTAPS-PPS POSITION POLARITY SWITCH SIGNAL VECTOR GUIDEMAP UPDATES: MONDAY 2/24/14 1014PM EST: ASIAN MARKET HOURS: QUARTERLY ECHOVECTOR ANALYSIS PERSPECTIVE

/ES EMINI FUTURES S&P500 ECHOVECTOR PIVOT POINT ANALYSIS FRAMECHART AND OTAPS-PPS SIGNAL FORECAST PRICE TRIGGER GUIDEMAP FOR MONDAY 2/24/14: 1120AMEST UPDATE: US REGULAR MARKET HOUR 1024AMEST UPDATE: WEEKLY AND DAILY ECHOVECTOR ZOOM PERSPECTIVE

/ES ECHOVECTOR ANALYSIS FRAMECHARTS: MONDAY 2/24/14 UPDATE

BONDPIVOTS.COM AND MARKET-PIVOTS.COM: TLT ETF ECHOVECTORVEST MDPP FORECAST AND ALERT RIGHT ON TARGET: ECHOVECTORVEST MDPP PRECISION PIVOTS TREASURY LONG BOND FRAMECHART AND OTAPS-PPS PRICE GUIDEMAP UPDATE: TLT ETF PROXY: MONDAY 2/24/14: RIGHT ON T

/ES E-MINI FUTURES SP500 ECHOVECTOR FRAMECHART UPDATES AND ANALYSIS FOR AM THURSDAY 2/20/14: SPYPIVOTS.COM AND E-MINIPIVOTS.COM AND MARKET-PIVOTS.COM AND ETFPIVOTS.COM: PREMIUM DESK PARTIAL RELEASE

NUGT ETF GOLD MINERS 3X ULTRA ECHOVECTOR PIVOT POINT ANALYSIS FRAMECHART AND OTAPS-PPS ACTIVE ADVANCED MANAGEMENT MODEL GUIDEMAP UPDATES: PREMIUM RELEASE PARTIAL PERSPECTIVES TO FREE ONLINE ALPHA BRAND NEWSLETTERS: US EXTENDED HOURS MARKET: 2/18/14

GOLDPIVOTS.COM: POWERFUL RESULTS: FORECAST RIGHT ON TARGET: TUESDAY 2/18/14: GLD ETF PROXY GOLD METALS MARKET ECHOVECTOR PIVOT POINT ANALYSIS FRAMECHART AND OTAPS-PPS ACTIVE ADVANCED MANAGEMENT MODEL GUIDEMAP UPDATES: PREMIUM RELEASE PARTIAL PERSPECTIVES

DJIA LARGE CAP COMPOSITE INDEX: TUESDAY 18 FEBRUARY 2014 UPDATE: POWERFUL RESULTS RIGHT ON TARGET: ECHOVECTOR PIVOT POINT FRAMECHART AND ANALYSIS UPDATES: /YM EMINI FUTURES

S&P500 STOCK COMPOSITE INDEX /ES EMINI FUTURES: POWERFUL FORECAST RESULTS RIGHT ON TARGET: The Presidential Cycle And Related Coordinate Forecast EchoVectors And OTAPS Position Polarity Switch Vectors UPDATE: WEDNESDAY 19 FEBRUARY 2014

NUGT ETF 3X ULTRA GOLD MINERS MARKET PROXY ECHOVECTOR PIVOT POINT ANALYSIS FRAMECHART AND OTAPS-PPS ACTIVE ADVANCED MANAGEMENT MODEL GUIDEMAP UPDATES: WEDNESDAY 2/12/14 EUROPEAN MARKET OPEN

DOWPIVOTS.COM & E-MINIPIVOTS.COM: ECHOVECTOR PIVOT POINT ANALYSIS FRAMECHARTS & ACTIVE ADVANCED MANAGEMENT OTAPS-PPS GUIDEMAPS UPDATE: /YM DOW FUTURES: THUR 2/06/14: POWERFUL RESULTS & MAJOR SUCCESS: PREMIUM RELEASES TO FREE ONLINE ALPHA BRAND NEWSLETTERS

GOLDPIVOTS.COM: POWERFUL RESULTS: FORECAST RIGHT ON TARGET: THU 2/6/14: /GC E-MINI FUTURES PROXY GOLD METALS MARKET ECHOVECTOR PIVOT POINT ANALYSIS FRAMECHART AND OTAPS-PPS ACTIVE ADVANCED MANAGEMENT GUIDEMAP UPDATES: PREMIUM RELEASE PARTIAL PERSPECTIVES

GOLDPIVOTS.COM POWERFUL RESULTS: FORECAST RIGHT ON TARGET: THU 1/30/14: ECHOVECTOR PIVOT POINT ANALYSIS FRAMECHART & OTAPS-PPS ACTIVE ADVANCED MANAGEMENT MODEL GUIDEMAP UPDATES: PREMIUM RELEASE PARTIAL PERSPECTIVES TO FREE ONLINE ALPHA BRAND NEWSLETTERS

QQQPIVOTS.COM POWERFUL RESULTS: FORECAST RIGHT ON TARGET: THU 1/30/14: ECHOVECTOR PIVOT POINT ANALYSIS FRAMECHART AND OTAPS-PPS ACTIVE ADVANCED MANAGEMENT MODEL GUIDEMAP UPDATES: PREMIUM RELEASE PARTIAL PERSPECTIVES TO FREE ONLINE ALPHA BRAND NEWSLETTERS

S&P500 COMPOSITE /ES EMINI FUTURES: The Presidential, Congressional, Annual, Tri-Quarterly, Bi-Quarterly, Quarterly, Monthly, Tri-Weekly, Bi-Weekly, And Weekly Cycles, & Related Coordinate Forecast EchoVectors & OTAPS Position Polarity Switch Vectors

THIS WEEK'S ECHOVECTOR PIVOT POINT ANALYSIS FRAMECHART AND ACTIVE ADVANCED MANAGEMENT OTAPS POSITION POLARITY SWITCH GUIDEMAP UPDATES: QQQ ETF, GLD ETF, USO ETF, /YM DOW FUTURES, /ES S&P500 FUTURES, LAST WEEK'S POWERFUL RESULTS: UPDATE MONDAY 1/27/14

/YM DOW FUTURES DJIA PROXY ECHOVECTOR FRAMECHART & TRADER'S EDGE PRICE FORECAST OTAPS VECTOR SWITCH GUIDEMAP UPDATES: LARGE CAP EQUITIES COMPOSITE INDEX FORECAST AND ALERTS RIGHT ON TARGET: PREMIUM NEWSLETTER ANALYSIS PARTIAL RELEASE: THURSDAY 1/23/14:

USO ETF AND GTU ETF: ECHOVECTOR ANALYSIS PIVOT POINT PRICE PROJECTION FRAMECHART UPDATES & TRADER'S EDGE OTAPS PRICE FORECAST GUIDEMAPS: OILPIVOTS.COM CRUDE OIL & GOLDPIVOTS.COM GOLD METALS FOCUS INTEREST PROXY FRAMECHARTS: WEDNESDAY 1/22/14

/YM EMINI DOW FUTURES & QQQ ETF: ECHOVECTOR ANALYSIS PIVOT POINT PRICE PROJECTION FRAMECHART UPDATES & TRADER'S EDGE OTAPS PRICE FORECAST GUIDEMAPS: DOWPIVOTS.COM DJIA & QQQPIVOTS.COM NASDAQ-100 FOCUS INTEREST PROXY FRAMECHARTS: TUESDAY 1/21/14 UPDATES

/YM FUTURES DJIA PROXY ECHOVECTOR FRAMECHART & TRADER'S EDGE PRICE GUIDEMAP UPDATE: ECHOVECTORVEST MDPP PRECISION PIVOTS LARGE CAP EQUITIES COMPOSITE FORECAST AND ALERT RIGHT ON TARGET: FRIDAY 17 JANUARY 2014: EARLY MORNING EUROPEAN PRE-MARKET OPEN UPDATE

/YM DOW FUTURES DJIA PROXY ECHOVECTOR FRAMECHART & TRADER'S EDGE GUIDEMAP UPDATE: ECHOVECTORVEST MDPP PRECISION PIVOTS LARGE CAP EQUITIES COMPOSITE FORECAST & ALERT RIGHT ON TARGET: POWERFUL FORECAST RESULTS FOR THURS 1/16/14 LATE MORNING: DOWPIVOTS.COM

QQQPIVOTS.COM AND ETFPIVOTS.COM AND MARKETPIVOTS.COM: QQQ ETF ECHOVECTOR ANALYSIS FRAMECHART AND TRADER'S EDGE GUIDEMAP UPDATE: KEY ANNUAL ECHOVECTOR AND QUARTERLY ECHOVECTORS HIGHLIGHTED & ILLUSTRATED: RIGHT ON TARGET: POWERFUL RESULTS: THURSDAY 1/16/14

/YM DOW FUTURES DJIA PROXY ECHOVECTOR FRAMECHART & TRADER'S EDGE GUIDEMAP UPDATE: ECHOVECTORVEST MDPP PRECISION PIVOTS LARGE CAP EQUITIES COMPOSITE FORECAST & ALERT RIGHT ON TARGET: POWERFUL FORECAST RESULTS FOR THURSDAY 1/16/14: DOWPIVOTS.COM

GTU ETF PROXY GOLD METALS MARKET ECHOVECTOR ANALYSIS FRAMECHART: Mid-Week EchoVector Analysis FrameChart And EchoVector Pivot Point Price GuideMap: ECHOVECTOR ANALYSIS RIGHT ON TARGET!

USO CRUDE OIL ECHOVECTORVEST ALERT ON SUNDAY 29 DECEMBER 2013 RIGHT ON TARGET: POWERFUL RESULTS FROM DOUBLE-DOUBLE LEVERAGE ALERT: MULTI-PERSPECTIVE ECHOVECTOR ANALYSIS & FRAMECHART & PRICE MAP UPDATE FOR MONDAY 1/1314: OILPIVOTS.COM & COMMODITYPIVOTS.COM

BONDPIVOTS.COM AND MARKET-PIVOTS.COM: TLT ETF ECHOVECTORVEST MDPP FORECAST AND ALERT RIGHT ON TARGET: ECHOVECTORVEST MDPP PRECISION PIVOTS TREASURY LONG BOND PRICE MAP ALERT AND FRAMECHART UPDATE: TLT ETF PROXY: FRIDAY 10 JANUARY 2014: RIGHT ON TARGET

SPX S&P500 ECHOVECTOR FRAMECHART UPDATES: 16Y MATURITY, 8Y REGIME CHANGE, 6Y SENATORIAL, 5Y FEDERAL RESERVE, 4Y PRESIDENTIAL, & 2Y CONGRESSIONAL CYCLE PERSPECTIVES W/ KEY ACTIVE ECHOVECTORS & ECHOBACKDATES: MARKET-PIVOTS.COM & SPYPIVOTS.COM: 1/9/14 UPDATE

GLD ETF ECHOVECTOR FRAMECHART AND PRICE MAP UPDATES: GOLDPIVOTS.COM & COMMODITYPIVOTS.COM & ETFPIVOTS.COM & MARKET-PIVOTS.COM: : PREMIUM RELEASE PARTIAL PERSPECTIVES AND ANALYSIS TO ALPHA BRAND NEWSLETTERS FOR GENERAL PUBLIC PURVIEW: 1/9/14: ON TARGET

SCROLL DOWN TO VIEW SELECT NEWSLETTERS

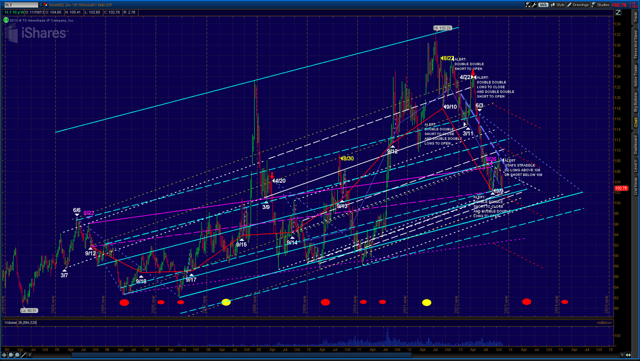

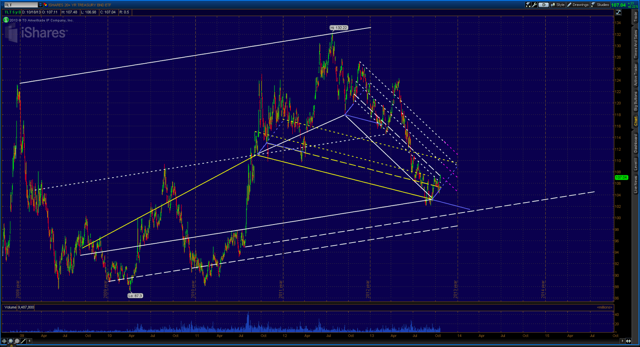

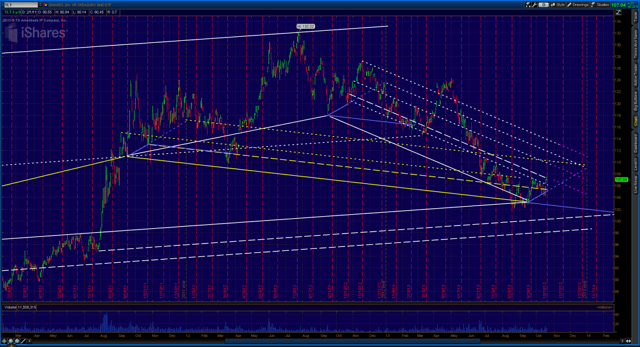

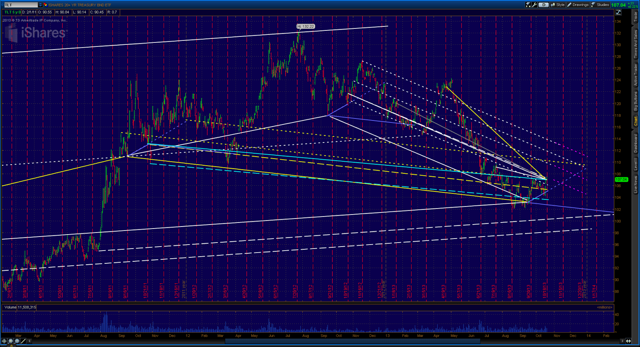

ECHOVECTOR ANALYSIS FRAMECHARTS OF THE DAY

ECHOVECTOR PIVOT POINT PROJECTION FRAMECHARTS OF THE DAY

ACTIVE ADVANCED MANAGEMENT OTAPS-PPS POSITION POLARITY COVER AND SWITCH SIGNAL INDICATOR

TIME/PRICE VECTOR GUIDEMAPS OF THE DAY

ACTIVE ADVANCED MANAGEMENT OTAPS-PPS POSITION POLARITY COVER AND SWITCH SIGNAL INDICATOR

TIME/PRICE VECTOR GUIDEMAPS OF THE DAY

COORDINATE FORECAST ECHOVECTOR PIVOT POINT PROJECTION FRAMECHARTS

AND OTAPS-PPS POSITION POLARITY SWITCH SIGNAL TIME/PRICE VECTOR GUIDEMAPS OF THE DAY

ADDITIONAL POSITION ALERTS AND OTAPS-PPS POSITION POLARITY SWITCH SIGNAL ALERTS

AND STRATEGY NOTES OF THE DAY

AND STRATEGY NOTES OF THE DAY

COMMENTARY, ANALYSIS, OUTLOOKS, AND FORWARD FORECASTS OF THE DAY

AND COMING SELECTED FOCUS INTEREST OPPORTUNITIES

AND COMING SELECTED FOCUS INTEREST OPPORTUNITIES

HOW TO ENLARGE FRAMECHARTS AND PRICE MAPS

______________________________________________________________________________________

HOW TO ENLARGE ECHOVECTORVEST MDPP PRECISION PIVOTS ECHOVECTOR ANALYSIS FRAMECHARTS AND FORECAST MODEL PRICE MAP IMAGES ON YOUR COMPUTER MONITOR'S DISPLAY

1. Left click on presented image of chart to open image of chart in new tab.

2. Right click on new image of chart opened in new tab to further zoom and enlarge EchoVector Analysis chart image illustrations and highlights.

1. Left click on presented image of chart to open image of chart in new tab.

2. Right click on new image of chart opened in new tab to further zoom and enlarge EchoVector Analysis chart image illustrations and highlights.

______________________________________________________________________________________

Wednesday, March 5, 2014

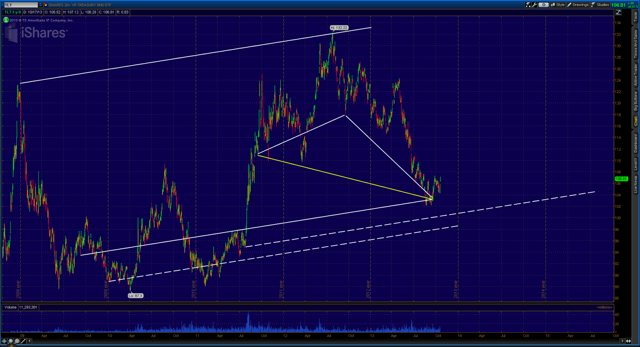

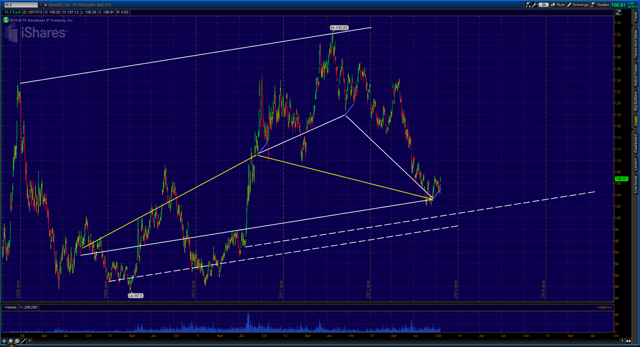

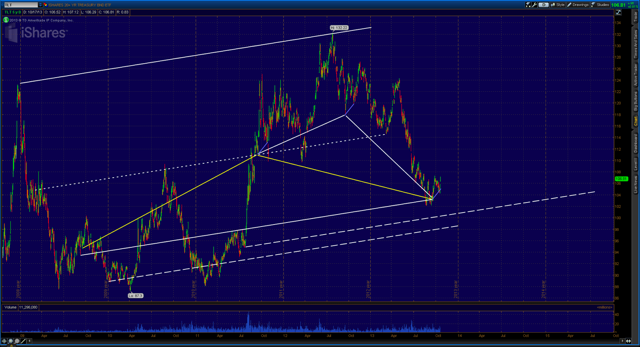

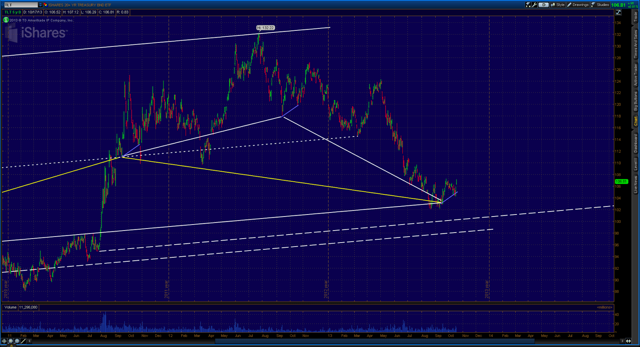

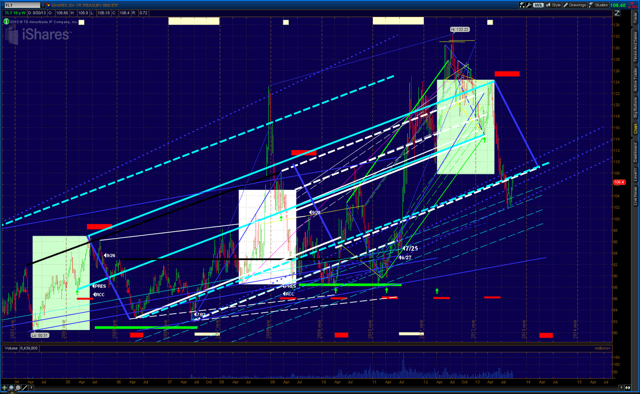

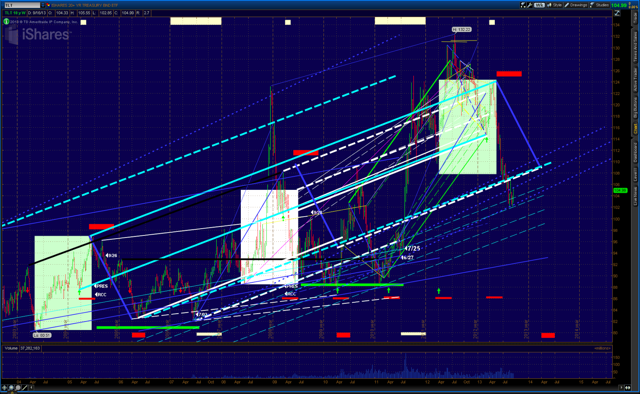

TLT ETF ECHOVECTOR ANALYSIS FRAMECHART AND OTAPS-PPS ACTIVE ADVANCED MANAGEMENT MODEL GUIDEMAP UPDATE: POWERFUL FORECAST AND ALERT RESULTS RIGHT ON TARGET: 3/5/14: PREMIUM DESK RELEASE PERSPECTIVES TO MARKET ALPHA NEWSLETTERS BRAND AND GROUP & SA

PROTECTVEST AND ADVANCEVEST MDPP PRECISION PIVOTS PREMIUM DESK PARTIAL RELEASE

TO FREE ONLINE MARKET ALPHA BRAND NEWSLETTER GROUP BY BRIGHTHOUSE PUBLISHING AND TO SEEKINGALPHA.COM

FOR FURTHER AND MOST RECENT AND TIMELY FREE ONLINE PUBLIC RELEASE UPDATES SEE

THE GOLD PIVOTS FORECASTER AND POSTION MANAGEMENT NEWSLETTER

TLT ETF 8-YEAR WEEKLY OHLC REGIME CHANGE CYCLE ECHOVECTOR ANALYSIS PERSPECTIVE FRAMECHART

ZOOMED TO 4-YEAR PRESIDENTIAL CYCLE ECHOVECTOR ANALYSIS PERSPECTIVE

TO FREE ONLINE MARKET ALPHA BRAND NEWSLETTER GROUP BY BRIGHTHOUSE PUBLISHING AND TO SEEKINGALPHA.COM

FOR FURTHER AND MOST RECENT AND TIMELY FREE ONLINE PUBLIC RELEASE UPDATES SEE

AND

RSS FEEDS AVAILABLE

BONDPIVOTS.COM & ETFPIVOTS.COM & MARKETPIVOTS.COM

CLICK ON CHART TO ENLARGE

TLT ETF 8-YEAR WEEKLY OHLC REGIME CHANGE CYCLE ECHOVECTOR ANALYSIS PERSPECTIVE FRAMECHART

TLT ETF 8-YEAR WEEKLY OHLC REGIME CHANGE CYCLE ECHOVECTOR ANALYSIS PERSPECTIVE FRAMECHART

ZOOMED TO 4-YEAR PRESIDENTIAL CYCLE ECHOVECTOR ANALYSIS PERSPECTIVE

PRIOR PREMIUM POST RELEASES TO MARKET ALPHA BRAND NEWSLETTERS FOR ADDITIONAL CONTEXT

BONDPIVOTS.COM AND MARKET-PIVOTS.COM: TLT ETF ECHOVECTORVEST MDPP FORECAST AND ALERT RIGHT ON TARGET: ECHOVECTORVEST MDPP PRECISION PIVOTS TREASURY LONG BOND PRICE MAP ALERT AND FRAMECHART UPDATE: TLT ETF PROXY: FRIDAY 10 JANUARY 2014: RIGHT ON TARGET [Edit orDelete]0 comments

BONDPIVOTS.COM AND COMMODITYPIVOTS.COM AND MARKET-PIVOTS.COM AND ETFPIVOTS.COMTLT ETF ECHOVECTOR FRAMECHART AND FORECAST PRICE MAP UPDATESECHOVECTORVEST - PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP PRECISION PIVOTS - INCLUDING MOTION DYNAMICS AND PRECISION PIVOTS MODEL ALERTS, OTAPS SIGNALS, CHART ILLUSTRATIONS, ANALYSIS, AND COMMENTARY IN REAL-TIME."Positioning for change; staying ahead of the curve; we're keeping watch for you!"THE ECHOVECTOR MARKET PRICE PIVOTS FORECASTER AND POSITION MANAGEMENT NEWSLETTERin association withTHE ETF PRICE PIVOTS FORECASTER AND POSITION MANAGEMENT NEWSLETTERandTHE E-MINI FUTURES PRICE PIVOTS FORECASTER AND POSITION MANAGEMENT NEWSLETTERFREE ONLINE VERSIONSCurrently regularly updated and FREE online version market newsletter group providing valuable and timely market price path analysis and price forecast charts and potential price pivot timing indicators, advanced market price echovectors and echovector price echo-back-dates, advanced forecast echovector price pivot points, key echovector price inflection points, and advanced coordinate forecast echovector support and resistance vectors for select stocks, bonds, commodities, currencies, and emerging markets composites, with a strong focus on select, proxying and indicative futures and ETF instruments in key markets.OUR RESEARCHING VIEWERSHIP NOW INCLUDES VIEWS FROM OVER 75 COUNTRIES AROUND THE WORLD! TOTAL VIEWS NOWINCLUDE REGISTERED VIEWS FROM...

Argentina/ Australia/ Austria/ Bangladesh/ Belarus/ Belgium/ Belize/ Bermuda/ Brazil/ Burma/ Canada/ Chile/ China/ Columbia/ Costa Rica/ Croatia/ Cyprus/ Czech Republic/ Ecuador/ Egypt/ Estonia/ France/ Finland/ Germany/ Greece/ Guam/ Guernsey/ Hong Kong/ Hungary/ India/ Indonesia/ Iraq/ Ireland/ Israel/ Italy/ Jamaica/ Japan/ Jordan/Kazakhstan/ Korea/ Latvia/ Lithuania/ Malaysia/ Mexico/ Namibia/ Nepal/ Netherlands/ New Zealand/ Nigeria/ Norway/ Panama/ Pakistan/ Philippines/ Poland/ Portugal/ Romania/ Russia/ Saudi Arabia/ Serbia/ Singapore/ Slovakia/ South Africa/ Sri Lanka/ Spain/ Sweden/ Switzerland/ Taiwan/ Thailand/ Trinidad and Tobago/ Turkey/ Ukraine/ United Arab Emirates/ United Kingdom/ United States/ Uzbekistan/ Venezuela/ Vietnam

PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP PRECISION PIVOTS ARTICLES HAVE APPEARED IN PUBLICATION OR IN SYNDICATION IN YEAR 2013 ATNasdaq, CNBC, MSN Money, Yahoo Finance, MarketWatch, Reuters, Barrons, Forbes, SeekingAlpha, BizNewsToday, Benzinga, Business Insider, Daily Finance, StreetInsider, Top10Traders, Fixed Income and Commodities, EchoVectorVEST, Financial Visualizations, YCharts, XYZ Trader Systems, ZeroHedge, Predict WallStreet, Financial RoundTable, Financial Board Central, Bullfax, BizWays, The Finance Spot, Business News Index, Regator, Streamica, BusinessBalla, Finanzachricten, StockLeaf, News Now UK, The Economic Times, Finance Pong, Seeking Alpha Japan, Gold News Today, GoldPivots, AurumX, Sharps Pixley News, Royals Metal Group, A-Mark Precious Metals, Sterling Investment Services, Austin Rare Coins and Bullion, Gold Trend, GoldPrice Today, Gold Rate 24, Check Gold Price, Silver Price News, Silver News Now, Silver Phoenix 500, Silver News, Silver Price, Silver Prices Today, Precious-Metals, VestTrader, Value Forum, Coin Info, Investment Four You, AidTrader, Trend Mixer, Indonesian Company, SiloBreaker, ETF Bannronn, SportBalla, Trading Apples, US Government Portal, Do It Yourself Investor, News Blogged, and others.See Also Related Web Sites and Blog Sites:market-pivots.com, stock-pivots.com, dowpivots.com, spypivots.com,goldpivots.com, oilpivots.com, bondpivots.com,dollarpivots.com,currencypivots.com, commoditypivots.com,emergingmarketpivots.com, etfpivots.com, echovectorpivotpoints.com, andseekingalpha.com/author/kevin-wilbur/instablog/tag/echovectorvest."For any base security I at price/time point A, A having real market transaction and exchange recorded print price p at exchange of record print time t, then EchoVector XEV of security I and of time length (cycle length) X with ending time/price point A would be designated and described as (I, Apt, XEV); EchoVector XEV's end point is (I, Apt) and EchoVector XEV's starting point is (I, Ap-N, t-X), where N is the found exchange recorded print price difference between A and the Echo-Back-Date-Time-And-Price-Point of A, being (A, p-N, t-X) of Echo-Back-Time-Length X (being Echo- Period Cycle Length X).A, p-n, t-X shall be called B (or B of I), being the EBDTPP (Echo-Back-Date-Time-And-Price-Point)*, or EBD (Echo-Back-Date)*, or EBTP (Echo-Back-Time-Point) of A of I.N = the difference of p at A and p at B (B being the 'echo-back-date-time-and-price-point of A found at (A, p-N, t-X.)And security I (I, Apt, XEV) shall have an echo-back-time-point (EBTP) of At-X (or I-A-EBTP of At-X; or echo-back-date (EBD) I-A-EBD of At-X): t often displayed on a chart measured and referenced in discrete d measurement length units (often OHLC or candlestick widthed and lengthed units[often bars or blocks]), such as 1-minute, 5-minute, 15-minute, 30-minute, hourly, 2-hour, 4-hour, 6-hour, 8-hour, daily, weekly, etc."_____________________________________________SCROLL DOWN TO VIEW SELECT NEWSLETTERECHOVECTOR ANALYSIS FRAMECHARTSOF THE DAYCOORDINATE FORECAST ECHOVECTOR PRICE MAPSOF THE DAYECHOVECTOR PIVOT POINT PROJECTIONFRAMECHARTS AND PRICE MAPSOF THE DAYPOSITION ALERTS AND STRATEGY NOTESOF THE DAYCOMMENTARY, ANALYSIS, AND FOREWARD FORECASTSOF THE DAY__________________________________________________________- DIRECT LINKS TO RECENT AND SELECT TOPICS, ARTICLES, POSTS, ANALYSIS, AND COMMENTARY

- Don't Fight The Fed (Still Very Much In Force)

on WED, Aug 1 • DIA, IYM, SPY, IWM, QQQ •GLOBALLY PUBLISHED AND SYNDICATED ARTICLE(First Published August, 2012) - Watch Out Gold

on THU, Sept 5, 2013• GLD, IAU, GTU, NUGT, SLV •PREMIUM ARTICLE NOW FREELY AVAILABLE GLOBALLY

- Today Is An Important Day For Gold

on FRI, Aug 31, 2013 • GLD, IAU, GTU, NUGT, SLV •GLOBALLY PUBLISHED AND SYNDICATED ARTICLE - Dow Heads To The Downside: It's Not Syria

on WED, Aug 28, 2013 • DIA, SPY, QQQ, IWM •GLOBALLY PUBLISHED AND SYNDICATED ARTICLE - Will Silver's Upside Price Action Continue?

on THU, Aug 22, 2013 • SLV, GLD, NUGT •GLOBALLY PUBLISHED AND SYNDICATED ARTICLE - As In Previous Quarters, This Is A Very Important Week In The Gold Market

on WED, Aug 14, 2013 • GLD, NUGT, IAU, GTU, SLV •GLOBALLY PUBLISHED AND SYNDICATED ARTICLE - Is Silver Setting Up For Significant Upside Price Action This Month?

on FRI, Aug 9, 2013 • GLD, NUGT, IAU, GTU, SLV •GLOBALLY PUBLISHED AND SYNDICATED ARTICLE - Could This Be A Correction That's Coming? An EchoVector Pivot Point Perspective

on WED, Aug 7, 2013 • DIA, IYM,SPY, DIA, IWM,QQQ •GLOBALLY PUBLISHED AND SYNDICATED ARTICLE - Today's EchoVector Pivot Point Chart And Analysis: The Long Treasury Bond

on MON, Aug 5, 2013 • TLT, BOND •GLOBALLY PUBLISHED AND SYNDICATED ARTICLE - Today's EchoVector Pivot Point Chart And Analysis: Silver

on WED, Jul 31, 2013 • SLV, AGOL, GLD •GLOBALLY PUBLISHED AND SYNDICATED ARTICLEGold Charts: Warning In February Still Valid Today

on MON, May 31, 2013 • GLD, GTU, IAU, NUGT, SLV •GLOBALLY PUBLISHED AND SYNDICATED ARTICLE

- Don't Fight The Fed (Still Very Much In Force)

HOW TO ENLARGE FRAMECHARTS AND PRICE MAPS______________________________________________________________________________________HOW TO ENLARGE ECHOVECTORVEST MDPP PRECISION PIVOTS ECHOVECTOR ANALYSIS FRAMECHARTS AND FORECAST MODEL PRICE MAP IMAGES ON YOUR COMPUTER MONITOR'S DISPLAY1. Left click on presented image of chart to open image of chart in new tab.

2. Right click on new image of chart opened in new tab to further zoom and enlarge EchoVector Analysis chart image illustrations and highlights.______________________________________________________________________________________CURRENT POST

ANALYSIS, ALERTS, OTAPS SIGNALS, CHART ILLUSTRATIONS, AND COMMENTARYThursday, January 9, 2014BONDPIVOTS.COM AND MARKET-PIVOTS.COM: TLT ETF ECHOVECTORVEST MDPP FORECAST AND ALERT RIGHT ON TARGET: ECHOVECTORVEST MDPP PRECISION PIVOTS TREASURY LONG BOND PRICE MAP ALERT AND FRAMECHART UPDATE: TLT ETF PROXY: FRIDAY 10 JANUARY 2014: RIGHT ON TARGETWITHQUARTERLY ECHOVECTOR AND COORDINATE FORECAST ECHOVECTOR (WHITE)BI-QUARTERLY ECHOVECTOR AND COORDINATE FORECAST ECHOVECTOR (YELLOW)ANNUAL ECHOVECTOR AND COORDINATE FORECAST ECHOVECTOR (WHITE)BI-ANNUAL ECHOVECTOR AND COORDINATE FORECAST ECHOVECTOR (YELLOW)PRESIDENTIAL CYCLE ECHOVECTOR AND COORDINATE FORECAST ECHOVECTOR (WHITE, GREEN)AND FOCUS INTEREST OPPORTUNITY FORECAST EXTENSION VECTOR ECHOES (PURPLE-BLUE)CLICK ON CHART TO ENLARGE. OPEN CHART IN NEW TAB AND CLICK ON CHART TO FURTHER ENLARGE AND ZOOMSEE COLOR CODE GUIDEhttp://echovectorvest.blogspot.com/2013/04/echovectorvest-mdpp-precision-pivots.htmlECHOVECTORS2RCCEV 16-YEAR: DOUBLE LONG AQUA-BLUE, DOUBLE LONG YELLOW, DOUBLE LONG BRIGHT PINK: NATIVITY CYCLE (DOUBLE REGIME CHANGE) ECHOVECTORRCCEV 8-YEAR: LONG AQUA-BLUE: REGIME CHANGE CYCLE ECHOVECTORSCEV 6-YEAR: LONG GREY: SENATORIAL CYCLE ECHOVECTORFRCEV 5-YEAR: BOY SCOUT GREEN: FEDERAL RESERVE CYCLE ECHOVECTORPCEV 4-YEAR: LONG WHITE, LONG GREEN, LONG RED: PRESIDENTIAL CYCLE ECHOVECTORCCEV 2-YEAR: YELLOW: CONGRESSIONAL CYCLE ECHOVECTORAEV 1-YEAR: WHITE, AQUA-BLUE: ANNUAL ECHOVECTOR3QEV 9-MONTH: GREY: TRI-QUARTERLY ECHOVECTOR2QEV 6-MONTH: AQUA-BLUE AND YELLOW AND PEACH: BI-QUARTERLY ECHOVECTORQEV 3-MONTH WHITE AND GREEN: QUARTERLY ECHOVECTORMEV 1-MONTH PEACH: MONTHLY ECHOVECTORCOORDINATE FORECAST ECHOVECTORS SPACEDADDITIONAL COORDINATE ECHOVECTOR LENGTHED PROJECTIONS WITH CORRESPONDING ECHO-BACKDATE AND/OR ECHO-FORWARDDATE PROJECTIONS: DOTTEDCOORDINATE HIGHLIGHTED EXTENSION VECTORS OF COORDINATE OR VARIED LENGTHS AND SLOPE MOMENTUMS: BLUE-PURPLETLT ETF 10-YEAR WEEKLY OHLC ECHOVECTOR FRAMECHART UPDATED FROM FRIDAY 25 AND OCTOBER 2013 ALERT;RIGHT ON TARGET____________________________________________________________________Sunday, December 29, 2013BONDPIVOTS.COM AND MARKET-PIVOTS.COM: TLT ETF CHOVECTORVEST MDPP FORECAST AND ALERT RIGHT ON TARGET: ECHOVECTORVEST MDPP PRECISION PIVOTS TREASURY LONG BOND PRICE MAP ALERT AND FRAMECHART UPDATE: TLT ETF PROXY: SUNDAY 29 DECEMBER 2013WITHQUARTERLY ECHOVECTOR AND COORDINATE FORECAST ECHOVECTOR (WHITE)BI-QUARTERLY ECHOVECTOR AND COORDINATE FORECAST ECHOVECTOR (YELLOW)ANNUAL ECHOVECTOR AND COORDINATE FORECAST ECHOVECTOR (WHITE)BI-ANNUAL ECHOVECTOR AND COORDINATE FORECAST ECHOVECTOR (YELLOW)PRESIDENTIAL CYCLE ECHOVECTOR AND COORDINATE FORECAST ECHOVECTOR (WHITE, GREEN)AND FOCUS INTEREST OPPORTUNITY FORECAST EXTENSION VECTOR ECHOES (PURPLE-BLUE)CLICK ON CHART TO ENLARGE. OPEN CHART IN NEW TAB AND CLICK ON CHART TO FURTHER ENLARGE AND ZOOMSEE COLOR CODE GUIDEhttp://echovectorvest.blogspot.com/2013/04/echovectorvest-mdpp-precision-pivots.htmlECHOVECTORS2RCCEV 16-YEAR: DOUBLE LONG AQUA-BLUE, DOUBLE LONG YELLOW, DOUBLE LONG BRIGHT PINK: NATIVITY CYCLE (DOUBLE REGIME CHANGE) ECHOVECTORRCCEV 8-YEAR: LONG AQUA-BLUE: REGIME CHANGE CYCLE ECHOVECTORSCEV 6-YEAR: LONG GREY: SENATORIAL CYCLE ECHOVECTORFRCEV 5-YEAR: BOY SCOUT GREEN: FEDERAL RESERVE CYCLE ECHOVECTORPCEV 4-YEAR: LONG WHITE, LONG GREEN, LONG RED: PRESIDENTIAL CYCLE ECHOVECTORCCEV 2-YEAR: YELLOW: CONGRESSIONAL CYCLE ECHOVECTORAEV 1-YEAR: WHITE, AQUA-BLUE: ANNUAL ECHOVECTOR3QEV 9-MONTH: GREY: TRI-QUARTERLY ECHOVECTOR2QEV 6-MONTH: AQUA-BLUE AND YELLOW AND PEACH: BI-QUARTERLY ECHOVECTORQEV 3-MONTH WHITE AND GREEN: QUARTERLY ECHOVECTORMEV 1-MONTH PEACH: MONTHLY ECHOVECTORCOORDINATE FORECAST ECHOVECTORS SPACEDADDITIONAL COORDINATE ECHOVECTOR LENGTHED PROJECTIONS WITH CORRESPONDING ECHO-BACKDATE AND/OR ECHO-FORWARDDATE PROJECTIONS: DOTTEDCOORDINATE HIGHLIGHTED EXTENSION VECTORS OF COORDINATE OR VARIED LENGTHS AND SLOPE MOMENTUMS: BLUE-PURPLETLT ETF 10-YEAR WEEKLY OHLC ECHOVECTOR FRAMECHART UPDATED FROM FRIDAY 25 AND OCTOBER 2013 ALERT;RIGHT ON TARGET_______________________________________________________________________________Thursday, December 5, 2013BONDPIVOTS.COM AND MARKET-PIVOTS.COM: TLT ETF CHOVECTORVEST MDPP FORECAST AND ALERT RIGHT ON TARGET: ECHOVECTORVEST MDPP PRECISION PIVOTS TREASURY LONG BOND PRICE MAP ALERT AND FRAMECHART UPDATE: TLT ETF PROXY: THURSDAY 5 DECEMBER 2013Open in new tab and click to enlarge and click again to further zoom. Click to enlarge.SEE COLOR CODE GUIDEECHOVECTORS

2RCCEV 16-YEAR: DOUBLE LONG AQUA-BLUE, DOUBLE LONG YELLOW, DOUBLE LONG BRIGHT PINK

RCCEV 8-YEAR: LONG AQUA-BLUE:SCEV 6-YEAR: LONG GREY: SENATORIAL CYCLEPCEV 4-YEAR: LONG WHITE, LONG GREEN, LONG RED: PRESIDENTIAL CYCLE ECHOVECTORCCEV 2-YEAR: YELLOW: CONGRESSIONAL CYCLE ECHOVECTORAEV 1-YEAR: WHITE, AQUA-BLUE: ANNUAL ECHOVECTOR3QEV 9-MONTH: GREY: TRI-QUARTERLY ECHOVECTOR2QEV 6-MONTH: YELLOW: BI-QUARTERLY ECHOVECTORQEV 3-MONTH WHITE: QUARTERLY ECHOVECTORCOORDINATE FORECAST ECHOVECTORS SPACEDADDITIONAL COORDINATE ECHOVECTOR LENGTHED PROJECTIONS WITH CORRESPONDING ECHOBACKDATE AND/OR ECHOFORWARDDATE PROJECTIONS: DOTTEDCOORDINATE HIGHLIGHTED EXTENSION VECTORS OF COORDINATE OR VARIED LENGTHS AND SLOPE MOMENTUMS: BLUE-PURPLE, GREENTLT ETF 10-YEAR WEEKLY OHLC ECHOVECTOR FRAMECHART UPDATE FROM FRIDAY 25 OCTOBER 2013 ALERT_______________________________________________________________________________Sunday, November 24, 2013BONDPIVOTS.COM AND MARKET-PIVOTS.COM: TLT ETF ALERT RIGHT ON TARGET: ECHOVECTORVEST MDPP PRECISION PIVOTS TREASURY LONG BOND PRICE MAP ALERT AND FRAMECHART UPDATE: TLT ETF PROXY: SUNDAY 24 NOVEMBER 2013Open in new tab and click to enlarge and click again to further zoom.Click to enlarge.SEE COLOR CODE GUIDEECHOVECTORS

2RCCEV 16-YEAR: DOUBLE LONG AQUA-BLUE, DOUBLE LONG YELLOW, DOUBLE LONG BRIGHT PINK

RCCEV 8-YEAR: LONG AQUA-BLUE:SCEV 6-YEAR: LONG GREY: SENATORIAL CYCLEPCEV 4-YEAR: LONG WHITE, LONG GREEN, LONG RED: PRESIDENTIAL CYCLE ECHOVECTORCCEV 2-YEAR: YELLOW: CONGRESSIONAL CYCLE ECHOVECTORAEV 1-YEAR: WHITE, AQUA-BLUE: ANNUAL ECHOVECTOR3QEV 9-MONTH: GREY: TRI-QUARTERLY ECHOVECTOR2QEV 6-MONTH: YELLOW: BI-QUARTERLY ECHOVECTORQEV 3-MONTH WHITE: QUARTERLY ECHOVECTORCOORDINATE FORECAST ECHOVECTORS SPACEDADDITIONAL COORDINATE ECHOVECTOR LENGTHED PROJECTIONS WITH CORRESPONDING ECHOBACKDATE AND/OR ECHOFORWARDDATE PROJECTIONS: DOTTEDCOORDINATE HIGHLIGHTED EXTENSION VECTORS OF COORDINATE OR VARIED LENGTHS AND SLOPE MOMENTUMS: BLUE-PURPLE, GREENTLT ETF 8-YEAR WEEKLY OHLC ECHOVECTOR FRAMECHART UPDATE FROM FRIDAY 25 OCTOBER 2013 ALERT_______________________________________________________________________________Wednesday, November 20, 2013BONDPIVOTS.COM AND MARKET-PIVOTS.COM: TLT ETF ALERT RIGHT ON TARGET: ECHOVECTORVEST MDPP PRECISION PIVOTS TREASURY LONG BOND PRICE MAP ALERT AND FRAMECHART UPDATE: TLT ETF PROXY: THURSDAY 21 NOVEMBER 2013SEE COLOR CODE GUIDEECHOVECTORS

2RCCEV 16-YEAR: DOUBLE LONG AQUA-BLUE, DOUBLE LONG YELLOW, DOUBLE LONG BRIGHT PINK

RCCEV 8-YEAR: LONG AQUA-BLUE:SCEV 6-YEAR: LONG GREY: SENATORIAL CYCLEPCEV 4-YEAR: LONG WHITE, LONG GREEN, LONG RED: PRESIDENTIAL CYCLE ECHOVECTORCCEV 2-YEAR: YELLOW: CONGRESSIONAL CYCLE ECHOVECTORAEV 1-YEAR: WHITE, AQUA-BLUE: ANNUAL ECHOVECTOR3QEV 9-MONTH: GREY: TRI-QUARTERLY ECHOVECTOR2QEV 6-MONTH: YELLOW: BI-QUARTERLY ECHOVECTORQEV 3-MONTH WHITE: QUARTERLY ECHOVECTORCOORDINATE FORECAST ECHOVECTORS SPACEDADDITIONAL COORDINATE ECHOVECTOR LENGTHED PROJECTIONS WITH CORRESPONDING ECHOBACKDATE AND/OR ECHOFORWARDDATE PROJECTIONS: DOTTEDCOORDINATE HIGHLIGHTED EXTENSION VECTORS OF COORDINATE OR VARIED LENGTHS AND SLOPE MOMENTUMS: BLUE-PURPLE, GREENOpen in new tab and click to enlarge and click again to further zoom.Click to enlarge.TLT ETF 8-YEAR WEEKLY OHLC ECHOVECTOR FRAMECHART UPDATE FROM FRIDAY 25 OCTOBER 2013 ALERT_____________________________________________________________________________________________________Sunday, November 10, 2013BONDPIVOTS.COM AND MARKET-PIVOTS.COM: TLT ETF ALERT RIGHT ON TARGET: ECHOVECTORVEST MDPP PRECISION PIVOTS TREASURY LONG BOND PRICE MAP ALERT AND FRAMECHART UPDATE: TLT ETF PROXYSEE COLOR CODE GUIDEECHOVECTORS

2RCCEV 16-YEAR: DOUBLE LONG AQUA-BLUE, DOUBLE LONG YELLOW, DOUBLE LONG BRIGHT PINK

RCCEV 8-YEAR: LONG AQUA-BLUE:SCEV 6-YEAR: LONG GREY: SENATORIAL CYCLEPCEV 4-YEAR: LONG WHITE, LONG GREEN, LONG RED: PRESIDENTIAL CYCLE ECHOVECTORCCEV 2-YEAR: YELLOW: CONGRESSIONAL CYCLE ECHOVECTORAEV 1-YEAR: WHITE, AQUA-BLUE: ANNUAL ECHOVECTOR3QEV 9-MONTH: GREY: TRI-QUARTERLY ECHOVECTOR2QEV 6-MONTH: YELLOW: BI-QUARTERLY ECHOVECTORQEV 3-MONTH WHITE: QUARTERLY ECHOVECTORCOORDINATE FORECAST ECHOVECTORS SPACEDADDITIONAL COORDINATE ECHOVECTOR LENGTHED PROJECTIONS WITH CORRESPONDING ECHOBACKDATE AND/OR ECHOFORWARDDATE PROJECTIONS: DOTTEDCOORDINATE HIGHLIGHTED EXTENSION VECTORS OF COORDINATE OR VARIED LENGTHS AND SLOPE MOMENTUMS: BLUE-PURPLE, GREENOpen in new tab and click to enlarge and click again to further zoom.Click to enlarge.TLT ETF 8-YEAR WEEKLY OHLC ECHOVECTOR FRAMECHART UPDATES FROM FRIDAY 25 OCTOBER 2013 ALERT_________________________________________________________________________________________________________Friday, October 25, 2013MARKET-PIVOTS.COM AND BONDPIVOTS.COM: TLT ALERT: BONDPIVOTS.COM TLT OTAPS WITH LFOUR OTAPS $108 WITH MULTI-PERSPECTIVE FRAMECHART UPDATE: ACTIVE REGIME CHANGE, PRESIDENTIAL, AND ANNUAL CYCLE ECHOVECTORS AND ECHOBACKDATES HIGHLIGHTED AND ILLUSTRATED WITH FORWARD TECHNICAL IMPLICATIONS: PREMIUM VIEW RELEASE TO OPEN SOURCE NEWSLETTER FOR GENERAL PUBLIC PURVIEW: PUBLIC RELEASE DATE FRIDAY 25 OCT 2013SEE COLOR CODE GUIDEECHOVECTORS

2RCCEV 16-YEAR: DOUBLE LONG AQUA-BLUE, DOUBLE LONG YELLOW, DOUBLE LONG BRIGHT PINK

RCCEV 8-YEAR: LONG AQUA-BLUE:SCEV 6-YEAR: LONG GREY: SENATORIAL CYCLEPCEV 4-YEAR: LONG WHITE, LONG GREEN, LONG RED: PRESIDENTIAL CYCLE ECHOVECTORCCEV 2-YEAR: YELLOW: CONGRESSIONAL CYCLE ECHOVECTORAEV 1-YEAR: WHITE, AQUA-BLUE: ANNUAL ECHOVECTOR3QEV 9-MONTH: GREY: TRI-QUARTERLY ECHOVECTOR2QEV 6-MONTH: YELLOW: BI-QUARTERLY ECHOVECTORQEV 3-MONTH WHITE: QUARTERLY ECHOVECTORCOORDINATE FORECAST ECHOVECTORS SPACEDADDITIONAL COORDINATE ECHOVECTOR LENGTHED PROJECTIONS WITH CORRESPONDING ECHOBACKDATE AND/OR ECHOFORWARDDATE PROJECTIONS: DOTTEDCOORDINATE HIGHLIGHTED EXTENSION VECTORS OF COORDINATE OR VARIED LENGTHS AND SLOPE MOMENTUMS: BLUE-PURPLE, GREENOpen in new tab and click to enlarge and click again to further zoom.Click to enlarge.TLT ETF 8-YEAR WEEKLY OHLC ECHOVECTOR FRAMECHARTST DOWNSIDE PRESSURE BIAS__________________________________________________________________________________________Sunday, October 20, 2013BONDPIVOTS.COM TLT OTAPS WITH LFOUR OTAPS $107.20 WITH MULTI-PERSPECTIVE FRAMECHART UPDATE: ACTIVE ANNUAL, BI-ANNUAL AND PRESIDENTIAL CYCLE ECHOVECTORS AND ECHOBACKDATES HIGHLIGHTED AND ILLUSTRATED WITH FORWARD TECHNICAL IMPLICATIONS: PREMIUM VIEW RELEASE TO OPEN SOURCE NEWSLETTER FOR GENERAL PUBLIC PURVIEW: PUBLIC RELEASE DATE SUNDAY 20 OCT 2013Click to enlarge. Open in new tab and click to enlarge and click again to further zoom.SEE ECHOVECTOR AND COORDINATE FORECAST ECHOVECTOR AND RELATED EXTENSION VECTOR COLOR CODE GUIDEPCEV 4-YEAR LONG WHITE.CCEV 2-YEAR LONG YELLOW, AQUA-BLUEAEV 1-YEAR WHITE3QEV 9-MONTH GREY2QEV 6-MONTH SHORT YELLOWQEV 3-MONTH SHORT WHITECOORDINATE EXTENSION VECTORS BLUE-PURPLETLT ETF 4-YEAR DAILY OHLCTLT ETF 3-YEAR DAILY OHLCTLT ETF 2-YEAR DAILY OHLCTLT ETF 2-YEAR DAILY OHLCTLT ETF 1-YEAR DAILY OHLCSee longer-term 8-year Regime Change Cycle Coordinate Forecast EchoVectors for 2013 year-end forecast implication on EchoVector FrameCharts below._________________________________________________________________________________________Thursday, October 17, 2013BONDPIVOTS.COM TLT OTAPS WITH LFOUR OTAPS 106.80 WITH MULTI-PERSPECTIVE FRAMECHART UPDATE: ACTIVE ANNUAL, BI-ANNUAL AND PRESIDENTIAL CYCLE ECHOVECTORS AND ECHOBACKDATES HIGHLIGHTED AND ILLUSTRATED WITH FORWARD TECHNICAL IMPLICATIONS: PREMIUM VIEW RELEASE TO OPEN SOURCE NEWSLETTER FOR GENERAL PUBLIC PURVIEW: PUBLIC RELEASE DATE THURSDAY 17 OCT 2013 400PM EDSTClick to enlarge. Open in new tab and click to enlarge and click again to further zoom.SEE ECHOVECTOR AND COORDINATE FORECAST ECHOVECTOR AND RELATED EXTENSION VECTOR COLOR CODE GUIDE4AEV-WHITE. 2AEV-YELLOW, AEV-WHITE,TLT ETF 5-YEAR DAILY OHLCTLT ETF 5-YEAR DAILY OHLCTLT ETF 5-YEAR DAILY OHLCTLT ETF 2-YEAR DAILY OHLCTLT ETF 2-YEAR DAILY OHLC_________________________________________________________________________________Monday, September 30, 2013BONDPIVOTS.COM: TLT ETF ECHOVECTOR FRAMECHART UPDATE: MONDAY 30 SEPT 2013 1117PM EDST: 8-YEAR WEEKLY OHLC PERSPECTIVE WITH KEY REGIME CHANGE CYCLE ECHOVECTORS AND COORDINATE FORECAST ECHOVECTORS AND ECHOBACKTIMEPOINTS AND ECHOBACKTIMEPERIODS(Click to enlarge. Open in new tab and click to enlarge and click again to further zoom.)TLT ETF 8-YEAR WEEKLY OHLCThursday, September 19, 2013TLT ETF ECHOVECTOR FRAMECHART UPDATE: 8-YEAR WEEKLY OHLC PERSPECTIVE WITH KEY REGIME CHANGE CYCLE ECHOVECTORS AND COORDINATE FORECAST ECHOVECTORS AND ECHOBACKTIMEPOINTS AND ECHOBACKTIMEPERIODSPosted by BY ECHOVECTORVEST MDPP PRECISION PIVOTS at 11:26 PM

Email ThisBlogThis!Share to TwitterShare to FacebookNo comments:Post a CommentSubscribe to: Post Comments (Atom)TranslateSelect LanguageAfrikaansAlbanianArabicArmenianAzerbaijaniBasqueBelarusianBengaliBosnianBulgarianCatalanCebuanoChinese (Simplified)Chinese (Traditional)CroatianCzechDanishDutchEsperantoEstonianFilipinoFinnishFrenchGalicianGeorgianGermanGreekGujaratiHaitian CreoleHausaHebrewHindiHmongHungarianIcelandicIgboIndonesianIrishItalianJapaneseJavaneseKannadaKhmerKoreanLaoLatinLatvianLithuanianMacedonianMalayMalteseMaoriMarathiMongolianNepaliNorwegianPersianPolishPortuguesePunjabiRomanianRussianSerbianSlovakSlovenianSomaliSpanishSwahiliSwedishTamilTeluguThaiTurkishUkrainianUrduVietnameseWelshYiddishYorubaZulu

Powered by TranslateTotal Page Views

TranslateTotal Page Views34,112

LINKS- Introduction To EchoVector Analysis And EchoVector Pivot Points

- EchoVectorVEST MDPP at SeekingAlpha/Instablogs

- EchoVectorVEST MDPP at SeekingAlpha/Articles

- EchoVectorVEST MDPP at Our Record

- What Is EchoVectorVEST MDPP?

- EchoVectorVEST MDPP at Twitter

- EchoVectorVEST MDPP Precision Pivots Model Highlights and Illustrations Color Code Guide: Active EchoVectors and Coordinate Forecast EchoVectors

- ProtectVEST and AdvanceVEST MDPP Precision Pivots Active Advanced Position Management Technology "On/Off/Through Target Application Price Switch (OTAPS)"

- ProtectVEST and AdvanceVEST MDPP Precision Pivots Active Advanced Management Strategies: Derivatives Baskets Reference Guide

RELATED LINKS- DOWPIVOTS.COM CHARTS

- GOLDPIVOTS,COM CHARTS

- OILPIVOTS.COM CHARTS

- BONDPIVOTS.COM CHARTS

- DOLLARPIVOTS.COM CHARTS

- CURRENCYPIVOTS.COM CHARTS

- COMMODITYPIVOTS.COM CHARTS

- EMERGINGMARKETPIVOTS.COM CHARTS

- SPYPIVOTS.COM CHARTS (S&P500PIVOTS)

- MDPP PRECISIONPIVOTS.COM CHARTS (COMPREHENSIVE SITE)

- OUR CHARTS ON TWITTER

- OUR CHARTS AT SEEKINGALPHA

- CHART COLOR CODE GUIDE AND BASIC LOGICS

HOW TO HYPER-ZOOM CHARTS

Click on chart to enlarge. Then left click on enlarged chart to open in new tab. Then click on chart in new tab to further zoom.)OTAPS ALERTS

Introducing the Active Advanced Management On/Off/Through Vector Target Application Price Switch. Position Management and Value Optimization Technology. See "OTAPS" Link Above.POSITION DOUBLE LEVERAGE AND DOUBLE DOUBLE LEVERAGE ALERTS

Introducing P&A Active Advanced Management Double and Double Double Positioning Technology For Select Instruments and Key Focus Interest Opportunity Periods. See Links Above.OPTIMIZING LEVERAGE WITH DERIVATIVES AND SYNTHETICS

Introducing ProtectVEST and AdvanceVEST Active Advance Derivatives Management Levels 1, 2, 3 , and 4 Technology For Position Value Hedging and Value Optimizing Strategies. See "DBRG," Derivatives Baskets Reference Guide, Link Above.ECHOVECTOR ANALYSIS FRAMECHARTS AND ECHOVECTOR FORECAST MODEL PRICE MAP ILLUSTRATIONS AND HIGHLIGHTS COLOR CODE GUIDE FORECHOVECTORS,ECHOBACKDATE-TIME-AND-PRICE-POINTS,COORDINATE FORECAST ECHOVECTORS,ECHOVECTOR PIVOT POINT PRICE PROJECTIONS,AND ECHOVECTOR SUPPORT AND RESISTENCE VECTORSECHOVECTORVEST MDPP PRECISION PIVOTS TRADER'S EDGE EASYGUIDECHARTSECHOVECTOR AND COORDINATE FORECAST ECHOVECTOR AND ECHOVECTOR PIVOT POINT COLOR CODE GUIDEECHOVECTORVEST MDPP PRECISION PIVOTS MODEL ECHOVECTOR ANALYSIS ECHOVECTOR WITH COORDINATE ECHOBACKDATE AND COORDINATE FORECAST ECHOVECTORS AND ECHOVECTOR PIVOT POINT ILLUSTRATIONS AND HIGHLIGHTS COLOR CODE GUIDE FOR TRADER'S EDGE EASYGUIDE FRAMECHARTS AND FORECAST PRICE MAPSCOLOR CODE GUIDE FOR FRAMECHARTS AND PRICE MAPS1. Maturity Cycle, Double Most Regime Change Cycle (16 Year, Week of Month):DoubleLongAquaBl2. Maturity Cycle, Double Most Regime Change Cycle (16 Year, Week of Month):Double Long Yellow3. Maturity Cycle, Double Most Regime Change Cycle (16 Year, Week of Month): Double Long Pink4. Regime Change Cycle EchoVector (8 Year, Week of Month): LongAqua-Blue5. Regime Change Cycle EchoVector (8 Year, Week of Month): LongYellow6. Regime Change Cycle EchoVector (8 Year, Week of Month): LongPink7. Senatorial Cycle EchoVector (6 Year, Week of Month): Long Grey8. Presidential Cycle EchoVector (4 Year, Day of Week): Long White

9. Presidential Cycle EchoVector (4 Year, Day of Week): Long Red

10. Presidential Cycle EchoVector (4 Year, Day of Week): Long Green

11. Presidential Cycle EchoVector (4 Year, Day of Week): Long Aqua-Blue12. Congressional Cycle EchoVector (2 Year, Day of Week): Long Green13. Congressional Cycle EchoVector (2 Year, Day of Week): Long Blue Purple14. Congressional Cycle EchoVector (2 Year, Day of Week): Long Pink15. Congressional Cycle EchoVector (2 Year, Day of Week): LongYellow16. 7 Quarters Cycle EchoVector, 7QEV (7 Quarters, Day of Week):Dark Grey

17. 6 Quarters Cycle EchoVector, 6QEV (6 Quarters, Day of Week):Pink

18. 5 Quarters Cycle EchoVector, 5QEV (5 Quarters, Day of Week):Peach19. Annual Cycle EchoVector (1 Year, Day of Week): Red20. Annual Cycle EchoVector (1 Year, Day of Week): Pink

21. Annual Cycle EchoVector (1 Year, Day of Week): Aqua-Blue

22. Annual Cycle EchoVector (1 Year, Day of Week): Long Blue Purple23. 9-Month Cycle EchoVector (9 Months, Day of Week): Grey24. Bi-Quarterly Cycle EchoVector (6 Months, Day of Week): Yellow, Peach

25. Bi-Quarterly Cycle EchoVector (6 Months, Day of Week): Grey, Aqua-Blue26. Quarterly Cycle EchoVector (3 Months, Day of Week): White

27. Quarterly Cycle EchoVector (3 Months, Day of Week): Grey

28. Quarterly Cycle EchoVector (3 Months, Day of Week): Red

29. Quarterly Cycle EchoVector (3 Months, Day of Week): Green30. Bi-Monthly Cycle EchoVector (2 Months, Day of Week): Black31. Monthly Cycle EchoVector (1 Month, Day of Week): Peach32. Bi-Weekly Cycle EchoVector (2 Weeks, Day of Week): Grey, Peach, Aqua-Blue, Yellow,White33. Weekly Cycle EchoVector (1 Week, Day of Week): Aqua Blue, Red,White, Blue-Purple34. 3-Day Cycle EchoVector (3 Day, Day-over-Day): Short Grey, ShortWhite35. 2-Day Cycle EchoVector (2 Day, Day-over-Day): Short Yellow,Short White36. Daily Cycle EchoVector (1 Day, Day-over-Day): Short Pink, ShortWhite, Short Blue-Purple38. Select Support and/or Resistance Vectors and/or Relative Price Extension Vectors (Various Lengths): Navy Blue and/or Blue Purple, Green, RedCOORDINATE FORECAST ECHOVECTORS: SPACEDADDITIONAL COORDINATE ECHOVECTOR LENGTHED PROJECTIONS WITH CORRESPONDING ECHOBACKDATE AND/OR ECHOFORWARDDATE PROJECTIONS: DOTTEDSee Links at Right for Information on Advanced OTAPS Signals

And Advanced L4 Derivatives Basket and Their Use In Active Advance Positioning And Position Management Strategies.READ "THE GOLD PIVOTS NEWSLETTER" at www.goldinvestorweekly.com(click on picture).

THE GOLD PIVOTS NEWSLETTER RSS FEED BY GOLD INVESTOR WEEKLY AND PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP PRECISION PIVOTS AND BY BRIGHTHOUSE PUBLISHING.THE WEEKLY NEWSLETTER SPECIALIZING IN GOLD PRICE ACTION AND GOLD PRICE PIVOTS AND GOLD PRICE FORECASTING FOR ADVANCED DAYTRADERS, ADVANCED SWING TRADERS, AND SEASONED MARKET PROFESSIONALS.Currently a regularly updated online newsletter providing valuable and timely analysis of the gold market, gold prices, advanced gold price forecast echovector pivot points and echovector price inflection points, and coordinate forecast echovector support and resistance vectors."Positioning for change... staying ahead of the curve... we're keeping watch for you."READ "THE SILVER PIVOTS NEWSLETTER" atwww.silverinvestorweekly.com (click on picture).

THE "SILVER PIVOTS NEWSLETTER" RSS FEED BY SILVER INVESTOR WEEKLY AND PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP PRECISION PIVOTS AND BY BRIGHTHOUSE PUBLISHING.THE WEEKLY NEWSLETTER SPECIALIZING IN SILVER PRICE ACTION AND GOLD PRICE PIVOTS AND GOLD PRICE FORECASTING FOR ADVANCED DAYTRADERS, ADVANCED SWING TRADERS, AND SEASONED MARKET PROFESSIONALS.Currently a regularly updated online newsletter providing valuable and timely analysis of the silver market, silver prices, advanced silver price forecast echovector pivot points and echovector price inflection points, and coordinate forecast echovector support and resistance vectors."Positioning for change... staying ahead of the curve... we're keeping watch for you."CLICK BELOW TO GET YOUR FREE CHARTS AND ANALYSIS BY RSS FEEDS AND/OR EMAIL

________________________________________________________________________________CLICK BELOW FOR FREE CHARTS AND ANALYSIS BY RSS FEEDS AND/OR EMAIL. Get Our Most CurrentPublicly Posted EchoVectorVEST MDPP Precision Pivots Model Generated OTAPS Alerts And "ECHOVECTOR PIVOT POINTS FORECAST CHARTS" AND "TRADER'S EDGE EASYGUIDECHARTS" Of The Day FREE As Soon As They Post!Just click on "Posts" or click on "All Comments" below (to select RSS feed and/or email), to 'enable' receiving your FREE and CURRENT EchoVectorVEST Trader's Edge EasyGuideCharts today!Get Timely Intra-Day, Multi-Day, Weekly, Bi-Weekly, Monthly, Bi-Monthly, Quarterly, Annual, Bi-Annual, And Longer-Term Model-Generated And/Or Methodology-Generated Chart Perspectives With EchoVector Analysis Based Highlights, Illustrations, And Coordinate Forecast EchoVectors And EchoVector Pivot Point Projections, And Active Advanced Position Management OTAPS Alerts, And Advanced Positioning Strategies, On Select, Highly Liquid, And Leading Major Market Securities, ETF's and Futures! ProtectVEST and AdvanceVEST by EchoVectorVEST MDPP Precision Pivots."Staying Ahead Of The Curve, We're Keeping Watch For You!"________________________________________________________________________________Subscribe to Precision Pivots

Posts

Posts

CommentsSearch This BlogECHOVECTOR PIVOT POINT INDICATOR CALCULATIONEasily Calculate A Basic Single Cycle Period Based EchoVector Pivot PointFrom The Information On Your Own Security's Price ChartECHOVECTORVEST BLOG LIST

CommentsSearch This BlogECHOVECTOR PIVOT POINT INDICATOR CALCULATIONEasily Calculate A Basic Single Cycle Period Based EchoVector Pivot PointFrom The Information On Your Own Security's Price ChartECHOVECTORVEST BLOG LIST- GOLDPIVOTS.COM AND MARKETPIVOTS.COM: FORECAST ST INTRADAY CAPITAL GAIN CAPTURE FOR THURSDAY IN THE GOLD METALS MARKET USING DOUBLE DOUBLE AND L4 DERIVATIVES BASKET: RIGHT ON TARGET

1 month ago - DOWPIVOTS.COM AND MARKET-PIVOTS.COM: ECHOVECTORVEST MDPP PRECISION PIVOTS LARGE CAP EQUITIES ALERT: /YM DOW FUTURES ECHOVECTOR FRAMECHART AND PRICE MAP PROXY UPDATE: 1-MONTH HOURLY OHLC: ALERT RIGHT ON TARGET: 1010PM WEDNESDAY 13 NOVEMBER 2012 PREMIUM

1 month ago - GOLDPIVOTS.COM AND MARKET-PIVOTS.COM: GLD ETF ALERT RIGHT ON TARGET: ECHOVECTORVEST MDPP PRECISION PIVOTS GOLD METALS ALERT PRICE MAP AND FRAMECHART UPDATE: GLD ETF PROXY: TUESDAY 12 NOVEMEBER 2013

1 month ago - OILPIVOTS.COM: USO ETF ECHOVECTOR ANALYSIS MULTI-PERSPECTIVE FRAMECHART UPDATES: PREMIUM PARTIAL VIEW RELEASE TO OPEN sOURCE NEWSLETTER COMPONENT FOR GENERAL PUBLIC PURVIEW ON SUNDAY 13 OCT 2013 "Staying ahead of the curve, positioning for change, we're keeping watch for you. ProtectVEST and AdvanceVEST by EchoVectorVEST"

2 months ago - Today Is An Important Day For Gold

4 months ago - TLT ETF ECHOVECTOR ANALYSIS CHART: 10-YEAR WEEKLY OHLC UPDATE: RIGHT ON TARGET

5 months ago - MAY 5 2013 US DOLLAR (UUP) ALERT AND FORECAST PROVES EXTREMELY TIMELY AND RIGHT ON TARGET

7 months ago

PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP BY ECHOVECTORVEST MDPP PRECISION PIVOTSProviding Forecasting and Trade Management Technology, Analysis, and Education Consistent With More Than Doubling the Portfolio Position Value of The Major Market (Dow 30 Industrials, DIA ETF) From Mid-2007 to Early 2009!... More Than Doubling Again from Early 2009 through 2010!... Then More Than Doubling Again in 2011!... And Then More Than Tripling Again in 2012!... "Positioning for change, staying ahead of the curve, we're keeping watch for you!"View my complete profile SPECIAL NOTATIONS

Special NotationsEchoVector Theory is a price pattern impact theory. EchoVector Analysis is an advanced technical analysis methodology. EchoVector Analysis is also presented as a behavioral economic application and securities analysis tool in price pattern theory and in price pattern behavior, study, and forecasting, and in securities analysis and price analysis and in securities price speculation.EchoVector Pivot Points, special contributions to the field of technical analysis, are a technical analysis tool and application within EchoVector Analysis, and derived from EchoVector Theory in practice.Kevin John Bradford Wilbur is the postulator of EchoVector Theory, the creator of EchoVector Analysis, and the inventor of EchoVector Pivot Points.Copyright 2013 EchoVectorVEST MDPP Precision PivotsBlog Archive- 2014 (14)

- January (14)

- BONDPIVOTS.COM AND MARKET-PIVOTS.COM: TLT ETF CHOV...

- SPYPIVOTS.COM AND STOCK-PIVOTS.COM AND ETFPIVOTS.C...

- GOLDPIVOTS.COM AND COMMODITYPIVOTS.COM AND ETFPIVO...

- GLD OTAPS WITH LFOUR OTAPS 117.55 RIGHT ON TARGET

- UUP OTAPS WITH LFOUR OTAPS 21.75

- TLT OTAPS WITH LFOUR OTAPS 102.65

- USO OTAPS WITH LFOUR OTAPS 33.15

- DIA OTAPS WITH LFOUR OTAPS 163.95

- GLD OTAPS WITH LFOUR OTAPS 118.50 RIGHT ON TARGET

- GLD OTAPS WITH LFOUR OTAPS 120.25 RIGHT ON TARGET....

- GLD OTAPS WITH LFOUR OTAPS 119.25. RIGHT ON TARGET...

- DOWPIVOTS.COM AND E-MINIPIVOTS.COM AND MARKET-PIVO...

- GOLDPIVOTS.COM AND COMMODITYPIVOTS.COM AND ETFPIVO...

- GLD OTAPS WITH LFOUR OTAPS 118.15. RIGHT ON TARGET...

- January (14)

- 2013 (1225)

- 2012 (1443)

Themes: Stock Market Education, Futures, Federal Reserve, Market Currents, ETFs, Macro View, Alerts, Market Outlook, Economy, ETF Long and Short Ideas, ETF Analysis, Long Ideas, Commodities,EchoVectorVEST, Technical Analysis, MDPP Precision Pivots ForecastStocks: GOVT, BOND, TBT, LQD, HYG, PLW, TMV, FSE, FSA, DLBS,DLBL, VGLT, LTPZ, ZROZ, TIPZ, TRSY, LBND, SBND, WIP, TLO, AGG,LWC, TLT- DIRECT LINKS TO RECENT AND SELECT TOPICS, ARTICLES, POSTS, ANALYSIS, AND COMMENTARY

Subscribe to: Post Comments (Atom)

No comments:

Post a Comment